| Size of the Industry | The Indian Soap Industry includes about 700 companies with combined annual revenue of about $17 billion. |

| Geographical distribution | All the major metropolitan cities |

| Output per annum | Indian per capita consumption of soap is at 460 gms per annum |

| Market Capitalization | 70% of India's population resides in the rural areas and around 50% of the soaps are sold in the rural markets. |

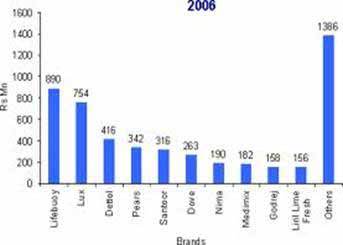

The toilet soaps market is estimated at 530,000 TPA including small imports where the Hindustan Lever is the market leader. The market has several, leading national and global brands and a large number of small brands. The popular brands include Lifebuoy, Lux, Cinthol, Liril, Rexona, and Nirma. Premium soaps are estimated to have a market volume of about 80,000 tonnes. This translates into a share of about 14 to 15%. However, by value it is as much as 30%.

Soap is a product for many people and the lathering up can be a treasured part of a morning or nightly routine. Whether it might be scented or unscented, in bars, gels, and liquids, soap is a part of our daily lives. In the United States, soap is a $1.390 million (US$) industry with over 50 mass market brands. But in Indian markets the sales potential for soap is only beginning to be realized. At the end of the year 2000, soap was a $1.032 million (US$) business in India.

India is a country with a population of 1,030 million people. With the household penetration of soaps is 98%. People belonging to different income levels use different brands, which fall under different segments, but all income levels use soaps, making it the second largest category in India. Rural consumers in India constitute 70% of the population. Rural demand is growing, with more and more soap brands being launched in the discount segment targeting the lower socio-economic strata of consumers. Soap manufacturers originally targeted their products to the lowest income strata in urban as well as rural areas, positioning their brands as a way to remove dirt and clean the body. For some brands, that positioning persists even today with a focus on removal of body odor and keeping the user healthy. However, soap positionings are moving towards skin care as a value-added benefit.

Soap is primarily targeted towards women, as they are the chief decision-makers in terms of soap purchase and for Medicated positionings like germ killing and anti-bacterial are marketed to families. About 75% of soap can be bought through the different types of outlets.This is the most common source for buying soap, which usually forms a part of the month's grocery list. Pan-Beedi Shops: These are really small shops, almost like handcarts, and they are primarily set up to dispense cigarettes and chewing tobacco.

Total annual soap sales by companies marketing their brands at national or state levels is estimated at 14,000 tonnes of a total soap market considered to be about 126,000 tonnes.

Today in the Indian economy the popular segments are 4/5ths of the entire soaps market. The penetration level of toilet soaps is 88.6%. Indian per capita consumption of soap is at 460 Gms per annum, while in Brazil it is at 1,100 grams per annum. In India, available stores of soaps are five million retail stores, out of which, 3.75 million retail stores are in the rural areas. 70% of India's population resides in the rural areas and around 50% of the soaps are sold in the rural markets.

|

|

One of the factors which affect the demand of soaps is the penetration, which the products have in market. In case of soaps this has not been a major issue as the penetration in the rural area is as high as 97% and that for urban area is around 99%. Thus approximately the penetration is around 99% for overall India.

- HLL

- Godrej Consumer Products Ltd

- Colgate Palmolive Ltd and

- Wipro Consumer Care

- In Indian Soap Industry the entry of new players in the 6,500-crore toilet soaps industry is expected to bring about a new twist in the "Indian soap opera".

- ITC Ltd has started investing in aggressive brand-building and product development projects to promote its brands, Fiama De Wills, Vivel and Superia.

- Godrej Consumer Products Ltd and Wipro Consumer Care Lighting are established players in the Industry which are beefing up their research projects and advertising plans to take on new rivals.

- With increasing competition, the Indian Soap Industry is expected to register a healthy growth this fisca. The sector registered a 15% value growth.

- GCPL is hiking its advertising budget by 20% to gain high visibility for its brands.

Recent Press Release

Recent Press Release

INDIAN soap Industry AT A Glance IN 2021 - 2022

INDIAN soap Industry AT A Glance IN 2021 - 2022

INDIAN soap Industry AT A Glance IN 2020 - 2021

INDIAN soap Industry AT A Glance IN 2020 - 2021

INDIAN soap Industry AT A Glance IN 2019 - 2020

INDIAN soap Industry AT A Glance IN 2019 - 2020

INDIAN soap Industry AT A Glance IN 2018 - 2019

INDIAN soap Industry AT A Glance IN 2018 - 2019

INDIAN soap Industry AT A Glance IN 2017 - 2018

INDIAN soap Industry AT A Glance IN 2017 - 2018

INDIAN soap Industry AT A Glance IN 2014 - 2015

INDIAN soap Industry AT A Glance IN 2014 - 2015

INDIAN soap Industry AT A Glance IN 2013 - 2014

INDIAN soap Industry AT A Glance IN 2013 - 2014

INDIAN soap Industry AT A Glance IN 2011 - 2012

INDIAN soap Industry AT A Glance IN 2011 - 2012

Indian Industries

|

INDIAN INDUSTRIES |