| Geographical distribution |

Andhra Pradesh, Gujarat and Karnataka |

| Output per annum |

Indian Tobacco and tobacco products earn a whopping annual sum of about Rs.10271 crores |

| Percentage in world market |

India today holds a meager 0.7% share of the US$ 30 bn global trade in tobacco, with cigarettes contributing for 85% of the country's total tobacco exports.

|

| Market Capitalization |

Indian Tobacco Industry's exports are likely to touch Rs. 16,050 million towards the end of current fiscal

|

History

History

In India the tradition of chewing tobacco has been from age old centuries. Around 48% is in the form of chewing tobacco out of the total tobacco produced in the country, were 38% as bidis, and only 14% as cigarettes. These bidis snuff and chewing tobacco (such as gutka, khaini and zarda) form the bulk (86%) of India's total tobacco production. Production of cigarettes is 90% of total production of tobacco related products in the rest of the world. In India Tobacco is an important commercial crop grown.

Tobacco production occupies the third position in the world with an annual production of about 725 Million Kgs. The production has different types grown like , flue-cured tobacco, country tobacco, burley, bidi and rustica. As an exporter of tobacco, India ranks sixth in the world next to Brazil, China, USA, Malawi and Italy.

Indian Tobacco and tobacco products earn a whopping annual sum of about Rs.10271 crores to the national exchequer by the way of excise revenue, and Rs.2022 Crores (2006-07) by way of foreign exchange. In India the per capita consumption of cigarettes is merely a tenth of the world average. The unique tobacco consumption pattern is the combination of tradition and more essentially the tax imposed on cigarettes. Cigarette smokers pay almost 85% of the total tax revenues generated from tobacco.

Brief introduction

Brief introduction

After China, India is the second largest producer of tobacco in the world. India has produced 572 m kgs of tobacco in 2003. However, India today holds a meager 0.7% share of the US$ 30 bn global trade in tobacco, with cigarettes contributing for 85% of the country's total tobacco exports. Of the total tobacco produced in the country, around 48% is consumed in the form of chewing tobacco, 38% as bidis, and 14% as cigarettes. Today India's per capita consumption of cigarettes in India is a tenth of the world average.

India has witnessed an unexpected increase in its tobacco exports, which has escalated by 55% to reach at $169 million in first quarter of 2008/09. Many big companies all around the world are showing their interest in purchasing tobacco at higher quantities from India and thanks to which the country's 2008-09 exports touced the mark of $600 million, which is 19% more than from $503 million of previous year. Indian exports have shown tremendous record at $169 million, which was $109 million in the same period a year ago. The biggest player in India Tobacco industry is ITC with a market share of 72%. Although it has been said that cigarette smoking is injurious to health but still, there is an increasing in the profit margin of the Indian Tobacco Company. With its wide range of invaluable brands, it leads from the front in every segment of the market. It's highly popular and highly consumed list of brands include Insignia, India Kings, Classic, Gold Flake, Silk Cut, Navy Cut, Scissors, Capstan, Berkeley, Bristol and Flake.

ITC has been able to reach the top position because of its single minded focus on value creation for the consumers via it's significant investments in product design, innovation, manufacturing technology, quality, marketing and distribution. ITC's cigarettes are produced in the state of factories which are situated at Bangalore, Munger, Saharanpur and Kolkata. These factories are known for their extremely high levels of quality, contemporary technology and work environment.

Market Capitalization

Market Capitalization

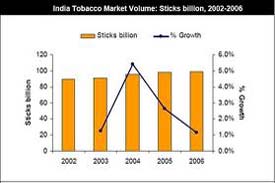

The Indian tobacco market generated total revenues of $9.9 billion in 2007, it represents a compound annual growth rate (CAGR) of 6.6% for the five-year period spanning 2003-2007.

ITC is the leading companies in the Indian tobacco market, holding a 72% share of the market's volume. Godfrey Philips accounts for a further 12% of the market's volume.

Size of the industry

Size of the industry

India is exporting tobacco today to 80 nations which is over all the continents in the world. At present the Indian Tobacco Industry is providing livelihood to more that 25 million people in the country. From the total tobacco items exported from India, the unmanufactured tobacco shares around 80 % to 85 % of the total exports while the manufactured tobacco products hold around nearly 20 % to 25 %. In the unmanufactured tobacco exports, Flue Cured Virginia tobacco accounts nearly 75 % to 80 % export. The other varieties are- Burley, HDBRG, Natu, DWFC, Top leaf and Jutty are also exported which are used in making cigarettes. Non cigarette tobacco exported worldwide is Lalchopadia, Judi, and Rustica are used for chewing and making bidis. Around 8 % to 10 % non- cigarette tobacco is exported in throughout the world. According to the international trends, non cigarette tobaccos are the dominating item in the national export. According to the current situation in the international tobacco market India is proved to emerge out as the favorable market for the Indian tobacco export. The prices of Brazilian export have almost equalized the most expensive American tobacco cost. Zimbabwean farm prices have also seen an upward trend. There are several advantages which can be put forth for favoring the Indian tobacco. Like low unit production cost, average export prices of tobacco in India, which are found more competitive than that of the prices of Brazil, USA, Zimbabwe.

India is one of the major producers of tobacco in the world - ranking third with a production of about 600,000 tonnes, after China (3,000,000 tonnes) and USA (700,000 tonnes). India is the fourth largest consumer of tobacco in the world. Many types of tobaccos are grown in India (not all are used for cigarettes).

Domestic and Export Share

Domestic and Export Share

Indian Tobacco Industry's exports are likely to touch Rs. 16,050 million towards the end of current fiscal from Rs. about Rs. 15060.20 million in last fiscal as its growers are set to export more than 60% of their produce in view of domestic tobacco's rising demand in countries like Russia, Vietnam, U.K., Germany and Belgium.

The estimates made by the Associated Chambers of Commerce and Industry of India (ASSOCHAM) on Prospects of Tobacco to Exports for Current Fiscal, emphasizing that domestic tobacco sector in the past few years has come out of recession, the impact of which would be favorable and amount to higher tobacco exports.

Top leading Companies

Top leading Companies

- Kanhayya Tobacco Company

- M.R Tobacco

- Sapna Enterprises

- Sudarshan Tobacco

- ITC Company

Employment opportunities

Employment opportunities

In the Indian Tobacco Company scenario there are a few more tobacco companies. These are the other Indian tobacco Companies which have made a name in the market, but are no way close to ITC. India is the third largest producer and eighth largest exporter of tobacco and tobacco products in the world which goes to show the tremendous success that the Indian Tobacco Company has achieved. While India's share in the world's area under tobacco crop has risen from 9% to 11% in the last 3 decades, its share in production has inched up from 8% to 9% in the tobacco industry. The major portion (80%) of raw tobacco production in the Indian Tobacco Company scenario comes from Andhra Pradesh, Gujarat and Karnataka.

Latest developments

Latest developments

- India is the second- largest producer of tobacco after China in the World. However, it holds a meagre 0.7 % share of the $30-billion global trade in tobacco.

- Cigarettes account for 85 %of the country's total tobacco exports.

- Of the total tobacco produced in the country, around 48. 5% is consumed in the form of chewing tobacco, 38 % as bidis, and 14 % as cigarettes.

- The per capita consumption of cigarettes in India is a tenth of the world average.

- In the recent past, the consumption of tobacco has been reduced by anti-tobacco drives and the ban of consumption in public areas.

- The biggest player in this industry is ITC with a market share of 72%.

Indian Industries

| Classified under RED category |

Aluminium industry, Cement industry, Construction industry, Copper industry, Dairy industry, Diamond industry, Fashion industry, Fertilizer industry, Film industry, Granite industry, Health care industry, Jewellery industry, Mining industry, Oil industry, Paint industry, Paper industry, Power industry, Printing industry, Rubber industry, Silk industry, Soap industry, Steel industry, Sugar industry, Textile industry, Tabacco industry, Zinc industry

|

| Classified under ORANGE category |

Automobile industry, Cotton industry, Hotel industry, Jute industry, Pharmaceutical industry, Tractor industry, Weaving industry |

| Classified under GREEN category |

Advertising industry, Agricultural industry, Aviation industry, Banking industry, Biotechnology industry, Biscuit industry, Chocolate industry, Coir industry, Cosmetic industry, Cottage industry, Electronic industry, Food Processing industry, Furniture industry, Garment industry, Insurance industry, IT industry, Leather industry, Music industry, Mutual fund industry, Pearl industry, Plastic industry, Poultry industry, Railway industry, Real estate industry, Shipping industry, Solar industry |

|

INDIAN INDUSTRIES |

|

|

|

|

|

Recent Press Release

Recent Press Release INDIAN tobacco Industry AT A Glance IN 2021 - 2022

INDIAN tobacco Industry AT A Glance IN 2021 - 2022 INDIAN tobacco Industry AT A Glance IN 2020 - 2021

INDIAN tobacco Industry AT A Glance IN 2020 - 2021 INDIAN tobacco Industry AT A Glance IN 2019 - 2020

INDIAN tobacco Industry AT A Glance IN 2019 - 2020 INDIAN tobacco Industry AT A Glance IN 2018 - 2019

INDIAN tobacco Industry AT A Glance IN 2018 - 2019 INDIAN tobacco Industry AT A Glance IN 2017 - 2018

INDIAN tobacco Industry AT A Glance IN 2017 - 2018 INDIAN tobacco Industry AT A Glance IN 2014 - 2015

INDIAN tobacco Industry AT A Glance IN 2014 - 2015 INDIAN tobacco Industry AT A Glance IN 2013 - 2014

INDIAN tobacco Industry AT A Glance IN 2013 - 2014 INDIAN tobacco Industry AT A Glance IN 2012 - 2013

INDIAN tobacco Industry AT A Glance IN 2012 - 2013 INDIAN tobacco Industry AT A Glance IN 2011 - 2012

INDIAN tobacco Industry AT A Glance IN 2011 - 2012

INDIAN TOBACCO INDUSTRY

INDIAN TOBACCO INDUSTRY